|

|

The final 9 consist of a wide variety of stocks. five of which were actually under what was paid for them. Note that all 5 of those losing stocks also paid a relatively high dividend at the time they were purchased.

SYY = Sysco Corporation

T = AT&T Inc.

TAP = Molson Coors Beverage Company

UPS = United Parcel Service

VTR = Ventas

VTRS = Viatris

VZ = Verizon Communications

WAB = Westinghouse Air Brake Technologies Corporation

XEL = Xcel Energy

The next 9 include some major tech giants from very different industries. The strange part is that the biggest company, Microsoft, also had the biggest percentage rise of all the stocks purchased in this group.

LOGI = Logitech International

MSFT = Microsoft Corporation

MU = Micron Technology

NLOK = NortonLifeLock

PFE = Pfizer

PG = The Procter & Gamble Company

PM = Philip Morris International

QCOM = QUALCOMM

SKT = Tanger Factory Outlet Centers

The next selection of stocks from the Stock Universe Portfolio. Some of these have dividends, but all were purchased over a year ago and held. Definitely not a fan of frequent trading, so these were all bought as investments.

EBAY = Ebay

EMR = Emerson Electric

GE = General Electric

HEAR = Turtle Beach

INTC = Intel

IVZ = Invesco

JNJ = Johnson & Johnson

KHC = Kraft Heinz Company

KMI = Kinder Morgan

There are currently 36 stocks in the Stock Universe Portfolio. At last check, only 8 of these were below what was paid for them and all have been held for at least one year.

Here are the first 9 of these stocks in alphabetical order:

AEP = American Electric Power Company

AMD = Advanced Micro Devices

ATVI = Activision Blizzard

CSCO = Cisco Systems

CTVA = Corteva

CVX = Chevron Corporation

DD = DuPont de Nemours

DHI = D.R. Horton

DOW = Dow

StockUniverse.com embarks on a journey across markets and space to discover planets of stocks! Yes, true to theme, each stock category that we cover will be getting its own planet. This will allow us to delve deeper into each company and industry. The best stocks as measured inside each planet will most likely land in Stock Universe Portfolios.

The Shooting Star Portfolio continues to do well in 2017. In fact, this will be the main portfolio that Stock Universe will focus on going forward.

Current Portfolio:

Netflix (NFLX)

Avago (AVGO)

Taser (TASR)

Gilead Sciences (GILD)

Skyworks (SWKS)

NXP Semiconductors (NXPI)

Sells:

TWTR and GPRO

Next Buys:

AMAT and AVAV

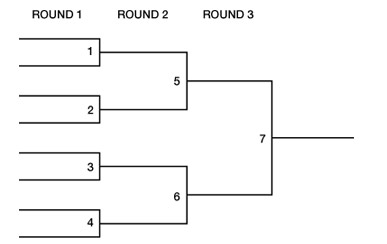

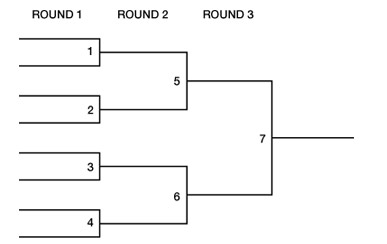

Ok, going to start with the first stock that will participate in the tournament. Each subsequent post will then contain a participant until all eight are officially chosen.

Stock Universe Stock Tournament Participants:

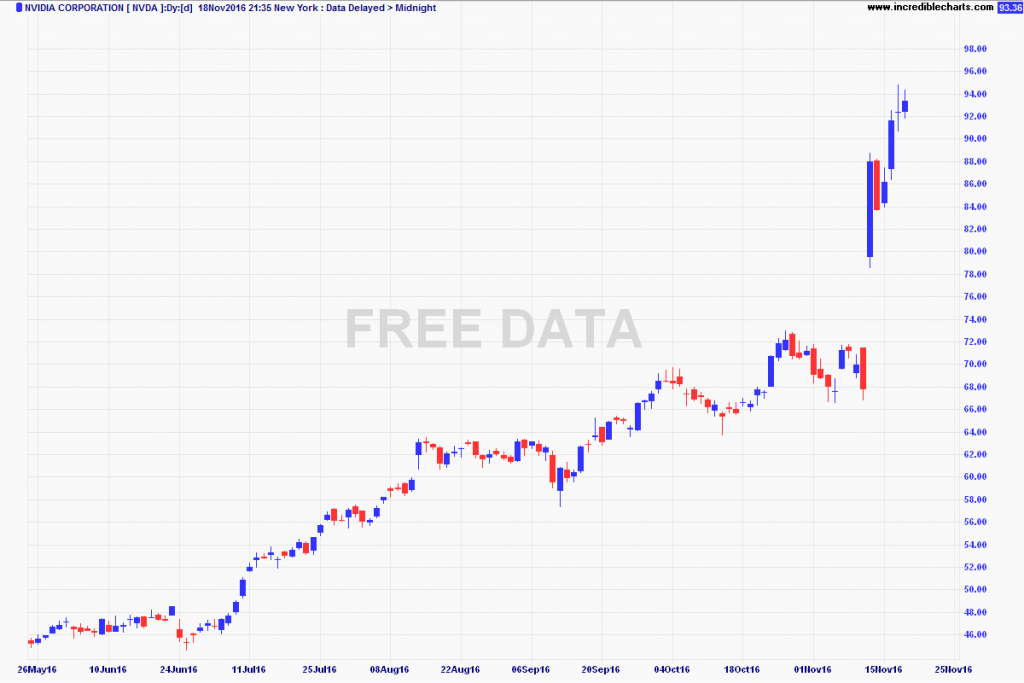

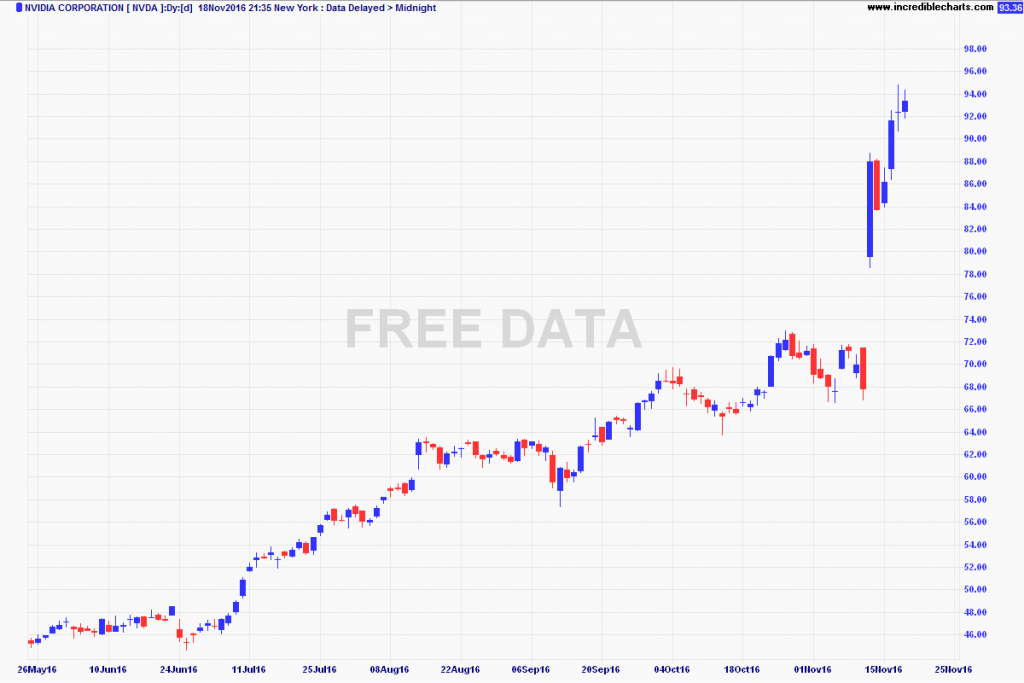

1. Nvidia (NVDA) – As can be seen in the chart above, NVDA has been going steadily up since late June. I was able to buy it for a portfolio right after Brexit hit the stock market. NVDA is currently not far from a new 52 week high at its current price of $93.36. The stock is fairly priced here, but it could continue with recent momentum.

This is one of those stocks of companies that I encounter quite often. Since I run GameOgre.com, I encounter most of the newest games in the PC market. These newer games have a high demand on the latest and greatest in graphics. The main provider of those hot graphics are graphics cards and Nvidia is the current king of graphics cards. No other graphic card maker really comes close. AMD is a rival, but it is not near as prominent as Nvidia. Plus, Nvidia does not have all the baggage that AMD has. NVDA shines as a pure play leader in a very important market. Graphics will continue to push the envelope whether they are on PCs or other devices.

Here is a real world of example of the importance of graphics in new PC games, I bought an Alienware computer back in 2009 for $3000. Now I am at the point that I have to pass on new blockbuster hits like Planet Coaster and Overwatch, because those games require DirectX11 and my current graphics card will not support that. Driver updates do not help either. The graphics card will simply not support Directx11. That means I need another card to play those games or I need a new PC. Want to keep my huge $3000 PC so I will probably get the latest Nvidia card that works on it. With its sound fundamentals, good growth possibilities, and soaring stock price, Nvidia enters the stock Universe Tournament.

This week was the historic presidential election and all the markets were in great turmoil leading up to the big day. Although all the polls seemed to indicate a different route, Donald Trump won the election to become the next President of the United States. However, this should not come as a complete surprise. The last debate, at least for me, showed which candidate had the most charisma and actually poise.

In fact, it was just one short period. This is when both candidates were asked the most important question of all the debates combined with all the negativity and arguing. A guy from the audience simply asked what was one good thing about the other candidate. This was the perfect opportunity to show character and community. Well, Hilary Clinton said one thing about his kids and then went back to negativity and her own agenda. In other words, she flubbed the crucial opportunity. Donald Trump actually answered the question correctly and stopped at that. I am not a political person and this is not a political site, but that one question and two answers showed me who had the charisma to win the election.

That said, stocks did not plummet as was predicted with a Trump win. Instead, he gave a good acceptance speech and the stock market actually rallied. Now that the election is finally over, some of the uncertain times are past us. Anybody who predicted the doom of the world likely already lost profits in stocks they sold. I was going to buy more if it fell big, but that did not happen.

Going forward, having just elected a president will help drive away uncertainty for the foreseeable future. Yes, there could be road bumps as he did stir the pot among some groups and there have been protests about the victory, but the stock market is clearly taking it as a positive for now. As always, focus on the best companies and their long term strengths and you should be fine.

Going to try something I have not done for stocks in over 15 years. When I first started writing for WallStreetCity.com, I started to write series of articles on certain industries. The first were game stocks and I started contacting the different game companies. This was before I started a game site of my own at GameOgre.com. Think it started with one article on games and then one of my contacts at that time suggesting a series on different game companies. Then once that series was completed, we did another and then so on. From that, the concept eventually evolved into a tournament to see which was the best company etc. The tournament took a great deal of work and there were skeptics including one who called it a “dog’s breakfast”, but the whole process rewarded me more than any other articles at that time. At least the ones I remember anyway.

Ok, this return to tournaments will be very short compared to those from many years ago, but they do need to be simple. If it works out, there should be more than the eight stocks we are starting with here. Look for th estocks to be named this week.

The fourth stock chosen has taken some time, but it was definitely worth the wait with Kraft-Heinz (KHC). The Stellar Seven portfolio buys this stock at $85.69. Kraft Heinz is not only a very strong company with more well known world-wide food brands than any other company, KHC is also a great dividend stock with a $2.30 per share dividend. In fact, Warren Buffet’s Berkshire Hathaway loves it so much as a dividend stock that it amounts for a whopping 20% of its entire portfolio! Besides Buffet being involved with the stock and the extensive brand portfolio, investors should note that the company’s products are recession resistant and generates considerable cash flow on a regular basis. With this in mind, we are starting to buy at this price and will continue to buy on any short term weakness.

Johnson and Johnson (JNJ) joins the Stellar Seven Portfolio on the strength of both excellent brands and strong dividends. In fact, JNJ is one of the best dividend paying companies in the entire world and have been for 53 straight years. Of course, this is not a stock to trade but to invest in. This particular stock falls under the long term investment category as the fundamentals are rock solid and should be for many years to come.

Once again, brand names drive the addition of a Stellar Seven Stock. This time, Campbell’s Soup (CPB) is the stock. Also the same is strength during a down market. In fact, CPB is raising guidance for the fiscal year. That is very impressive in a bear market and should not be ignored. This will mark five straight quarters that Campbell’s has reported better than expected revenue.

|

|