|

|

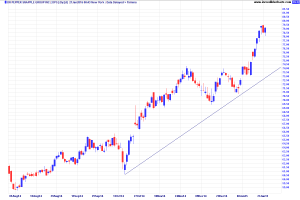

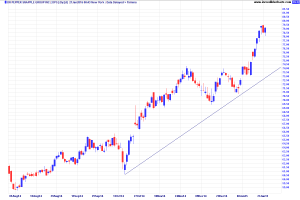

Dr. Pepper Snapple (DPS) is not exactly a new company or stock, but it has been acting like a new breed beverage company that has been strutting it stuff in front of the big two beverage giants known as Coke and Pepsi. Just take a quick look at the chart below to see what I am talking about. DPS has been doing extremely well, while the big two have been somewhat flat in comparison. When I was an active investor and stock analyst between 1994 and 2002, Coke was the undisputed beverage king with Pepsi a distant second in terms of the beverage side. Dr. Pepper has been a well-known soft drink but was tied into Cadbury Schweppes at that time and not doing much. Snapple was much younger, but was acquired by Quaker Oats in a great example of an acquisition that was a bad fit from start to finish. It also did not last long as Quaker Oats quickly sold Snapple again for much less than what it first paid for it.

Fast forward to 2008 and Dr.Pepper and Snapple are together after being spun-off from Cadbury Schweppes to form one of the biggest beverage companies in the world. The company owns such well-known brands as Dr Pepper, Snapple, 7 Up, Canada Dry, A&W, Crush, Squirt, Sunkist, Hawaiian Punch, and Motts. By focusing only on brands such as these instead of other areas like food and candy, the company has made itself very attractive to Wall Street.

DPS currently has a Price Earnings (P/E) Ratio of 22 and a Price Earnings to Growth Ratio of 2.55. Neither are exactly cheap, but that has not stopped the stock from recently hitting a 52 week high of $79.49. That said, it is above an attractive buy price right now. If the stock fell down to around the mid 70s, it would be much more attractive.

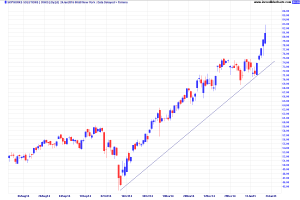

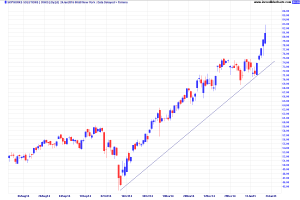

Skyworks (SWKS) has been on quite a run lately. It just hit a 52 week high of $82.78 before closing at $80.86. That is the price that StockUniverse “bought” a 100 shares for the Shooting Stars Portfolio. Skyworks hit a 52 week high today because it destroyed earnings estimates on Thursday. Earnings for the quarter shot up 88% to $1.26 for the 9th consecutive quarter of accelerating growth. That is what a shooting star is all about. Earnings estimates were beaten by 7 cents. Revenue rose past consensus estimates of $773.6 million to $805.5 million.

The company makes analog and mixed signal semiconductors. Its plethora of products include amplifiers, attenuators, battery chargers, power management devices, detectors, filters, hybrids, isolators, circulators, mixers, and modulators. These can be found in such areas as broadband, GPS, Wireless infrastructure, GPS, networking, smart phones, and tablet applications. The highest profile products are chips for Apple iPhones. Thus, the recent roll-outs of the IPhone 6 and iPhone 6 Plus helped considerably in the quarter. The Samsung GS5 also helped. SKWS even declared $.13 dividend that is payable on March 3rd.

As can be seen by the chart below, the stock is far from undiscovered. We are going to buy here as momentum continues but could also add to our position on any weakness.

This will be the second model portfolio for StockUniverse.com and will be handled much different than the first. Whereas the Shooting Star Portfolio focused on industry leaders in various forms of technology, this portfolio will start as a watchlist for many biotech stocks. The stocks on the list that breakout will be added to the official portfolio. Each stock added to the list will then have a stop loss. Stocks hitting that stop loss will be removed from the portfolio. Stocks in the portfolio will then have two price targets: one to reduce the position and take profits and the other to sell the whole position. All three prices will be named whenever each stock enters the portfolio.

Biotech Watchlist

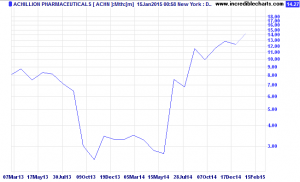

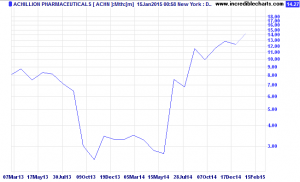

Achillion (ACHN) – $14.27

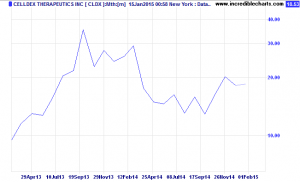

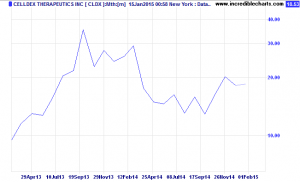

Celidex (CLDX) – $18.53

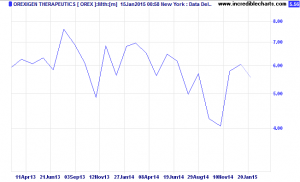

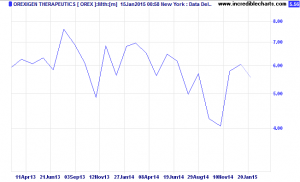

Orexigen (OREX) – $5.56

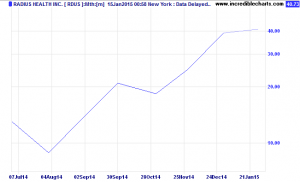

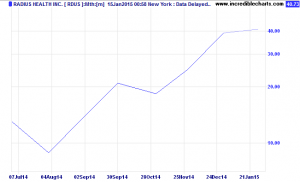

Radius (RDUS) – $40.73

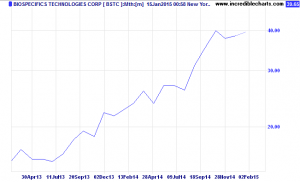

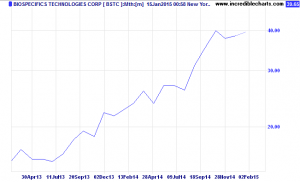

Biospecifics (BSTC) – $39.65

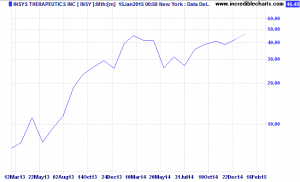

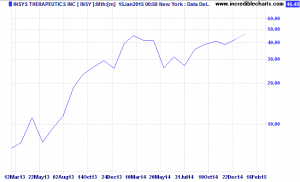

Insys (INCY) – $46.49

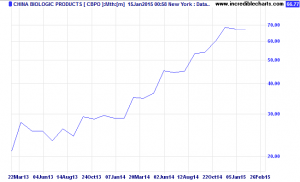

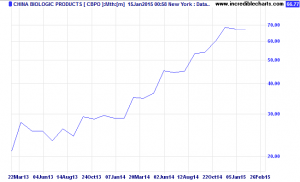

China Biologic (CBPO) – $66.77

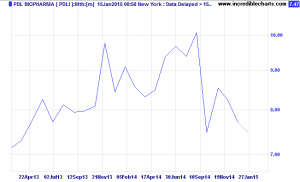

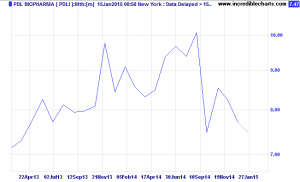

PDL (PDLI) – $7.47

Gilead Sciences (GILD) is a leading biotech company with a great product pipeline and impressive free cash flow. Like Avago, Gilead is very nimble for its market cap of $154.02 billion. GILD has a price to earnings (P/E) ratio of only 18 and price to earnings growth ratio of just .49. This ratio means that the stock is selling at almost half of of its earnings growth which should give it more upside at the current price. As can be seen by the chart below, the stock has been moving steadily up since late 2011.

Just recently, the biggest provider of health coverage to U.S. businesses chose Gilead’s Hepatitis C drug as the primary option for its patients with the most common type of Hepatitis C over a rival. In fact, Gilead has established itself as a clear leader in treating this disease while making billions of dollars in the process in 2014.

The Shooting Stars Portfolio is buying 75 shares of GILD at $102.21.

Avago (AVGO) is a component of the Shooting Star Portfolio here at StockUniverse.com. So far, it is one of the better components of the portfolio with a current price of $100 per share. It was bought at $77.15 back in early November and has been on the right of that price most of the time since. As can be seen by the chart below, AVGO has a rapidly growing stock price. In fact, the stock is not far from a 52 week high of $105 per share.

Avago makes semiconductors that are used in such products as cellphones, consumer appliances, enterprise storage, data networking, smart phones, and many more. The company is definitely in the right areas as sales have been skyrocketing for this large cap company. Last quarter, its sales jumped a whopping 115% from the same period the year before to $1.89 Billion. That is quite a feat for a company with a market cap close to $25 Billion.

Ambarella has been added to our Stock Universe portfolio known as Shooting Stars. Ambarella is definitely a shooting star as it has beat Wall Street expectations for 9 straight quarters. It gets better as this latest is the best earnings beat so far at a whopping 14 cents a share. With a current PEG ration of over 2, the stock is not cheap but definitely belongs in the portfolio. If needed, we will double down at lower levels. Would rather do that than miss the stock completely. The company is a major player in chips for video cameras, digital cameras, and security IP cameras. AMBA is a major supplier to GoPro which has also enjoyed a lot of growth recently. It also supplies Google wearables.

Price “Bought”

100 shares of AMBA at $54.69

Although I have not been around stocks much for the last 12 years or so, I was a very active investor in small technology stocks before, during, and after (for a while) the Internet Bubble burst. Returning to my stock roots this year has been very eye opening. I still recognize many of the stocks that I either owned or followed back in the day, but there are many of my past tech favorites that seemed to have vanished into thin air. Will list a few of both of these to see what happened to these companies and their respective stocks.

Off the Stock Radar:

Brooktrout Technology – One of my all-time favorites and made money off of more than once. Was bought out by Dialogic.

Softpoint – One of my first brushes with investing in a penny stock. Saw it on a TV commercial and called for a prospectus. Was a point of sale company that was de-listed many years ago.

Dialogic – Bought Brooktrout but last seen trading for pennies and has now been bought by a private equity firm.

Plasma-Therm – Was bought in 2000 by Swiss conglomerate Oerlikon and renamed Unaxis. Later, the company was bought by the management team in St. Petersburg in 2009 and renamed Plasma-Therm.

Transmeta – Once a hot IPO, Transmeta had great “potential”. Unfortunately that potentiual never really translated in good sales and earnings. The company was bought out and then defunct by 2009.

ADC Telecom – My first quality stock ever. Made money for me a couple of times. Was eventually acquired by Tyco Electronics in December 2010 and ceased to exist.

Still Around and Kicking:

Network Appliance (NTAP) – My favorite network storage stock that I wrote about many times for the old WallStreetCity.com. The stock really peaked during the Internet bubble back in 2000 and has never really returned to that top. However, it does trade at a decent P/E ratio of 22 and is very close to its 52 week high.

Brocade (BRCD) – My second favorite network storage company back in the day. It has a similar P/E ratio but the stock has been hit even harder than NTAP trading mostly under $10 for at least 12 years. This one may join the stocks above as there is a rumor that they could be looking to be bought out.

Qualcom (QCOM) – One of the favorites of the WallStreetCity team as a wireless leader. Is the closest of these stocks to rebound to its former stock price glory back in 2000.

Anadigics (ANAD) – Serves the broadband and wireless markets with radio frequency/microwave integrated circuit solutions. However, It was speculative stock then and it still is over 15 years later with a current price tag of only 77 cents.

MRV Communications (MRVC) – Basically starting looking after this stock after success with ADC Telecom. Was also a high-flying stock before the 2000 crash and saw moderate success after with a few dividends and a stock split. However, it is currently trading near a 52 week low of $9.26 per share.

The newest stock to be added to the Shooting Stars Portfolio is Lifelock (Lock). Similar to Taser in non-lethal defense, Lifelock is a leader in a growing industry based on a developing trend that could have strong legs for many years to come. ID Theft is not going anywhere and the company is continuing to grow despite a rather unimpressive stock price for 2014 so far. Look for this stock to pick up more steam as the company ramps up more growth. At a current price of $16.42, LOCK is trading in the middle of its 52 Week range. The valuation is decent for a technology stock with a bright future at 36. The PEG Ratio (Price to Earnings Growth) is even better at 1.09. The lower that number the better.

Price “Bought”

500 shares of LOCK at $16.42

Taser International (TASR) is the leading developer, manufacturer, and seller of conducted electrical weapons. These weapons are used in the military, law enforcement, and for consumers as personal self-defense. Law Enforcement, in particular, has been one of the main avenues of growth recently as several law enforcement agencies have made significant orders including the Louisiana State Police, the Las Vegas Metro Police, and the Arizona Department of Public Safety. However, let’s take a closer look at the personal defense side of the company since those are the products that we can buy and use to protect ourselves and our families.

Taser is the better and safer choice for personal defense over fire arms because it is a non-lethal solution and is generally allowed to be carried for protection without a license. A mistake with a gun can be fatal and traumatic for anybody involved. Bullets can also wound unnecessarily and cause damage to property. Tasers, on the other hand, perform their function almost flawlessly without all of that. There is essentially no risk to bystanders like there is with a stray bullet. There have been a few extreme cases over the years where somebody was hurt badly with a Taser, but those cases pale in comparison to what guns have done during the same time period.

Furthermore, Tasers are substantially better than other non-lethal self defense weapons such as stun guns and pepper spray for a couple of reasons. The first reason is what each weapon does to attackers. Stun Guns only cause pain to attackers in order to get the attackers to stop. Pepper spray also only causes pain to deter the attacker or attackers. This can be a major problem if the attacker is not deterred by the pain and continues the assault. Tasers, on the other hand, knock out the attackers completely to put an end to the attack in a non-lethal way so the defender can safely leave the scene.

The other major advantage for Tasers over other forms of Self-Defense is simply range. In fact, it is not even close. Stun guns must be thrust into the attackers up close, and some like batons are fairly big, while Pepper Spray has a range of about three feet. Pepper Spray has the further hindrance of possibly backfiring on the defender. Meanwhile, Tasers have a safe range up to 15 feet. Therefore, a defender has the time to use the weapon and to get away after the attacker is knocked out.

Moving on to the financials, growth for the company is also on the upswing. Taser reported solid third quarter earnings on October 30, 2014. Net sales increased 26% to $44 million from $35 million in the third quarter last year. Earnings per share (EPS) beat estimates by 5 cents. What is driving this sales and earnings growth? Although the company has a few other areas of potential growth such as Evidence.com and Axon Cameras , 90% of total sales still comes from its weapons segment.

Lastly, TASR’s recent stock price is also significant because it is close to $20 per share which is just stun gun distance away from its 52 week high of $20.83. Actually, that is also the 5 year high for the stock. If it gets past that high then it would likely get more attention from investors and then be looking to pass up its 10 year high share price of a little over $30 all the way back in 2004. If it continues to grow like it has been, 2015 could be a breakout year for Taser International.

The Shooting Star Portfolio on StockUniverse.com has gotten off to a great start. It appears to have been a great time to buy as a few of the stocks purchased are already up considerably. Twitter appears to be the stock with the most downside right now. Taser has been the biggest surprise to the upside so far as it nears new high territory for the year. Here the stock values of the portfolio so far:

BABA ($87.97) = $106.13

NFLX ($357.09) = $382.78

TWTR ($48.77) = $40.84

AVGO ($77.15) = $85.36

MSFT ($43.63) = $47.51

TASR ($15.05) = $18.49

Currently eyeing more stocks to add to the portfolio soon. A few of the bigger possible candidates are Apple, Clorox (Yes, Clorox), and Yahoo. All three have been moving up as of late so may just keep watching those until a buying opportunity opens up. Also look for each Shooting Star Stock in the portfolio to be profiled at least once.

Despite the very volatile nature of the stock market these days and the dreaded month of October for stocks, it is time to create the model portfolio for Stock Universe. Without a doubt, growth will be the biggest factor for being added to the portfolio. Valuations will also be a factor, but not at the expense of growth or potential for growth. Other factors will include industry leadership and overall industry outlook. Risk will be high overall, but the potential rewards could also be very high. To keep things simple, starting with $100,000 and will keep track of exact dates of when the stocks were bought and sold. Since this is virtual money (not real) for the model portfolio, commissions do not apply and will not be included.

Stock Universe’s Shooting Stars Portfolio

Netflix (NFLX) – 50 shares at $357.09

Twitter (TWTR) – 100 shares at $48.77

Avago (AVGO) – 100 shares at at $77.15

Taser (TASR) – 200 shares at $15.05

Gilead Sciences (GILD) – 75 shares at $102.21

Skyworks (SWKS) – 100 shares at 80.86

Gopro (GPRO) – 200 Shares at $38.73

NXP Semiconductors (NXPI) – 100 shares at $97.55

Cash – $33,326.75

As with every other industry, there are now a plethora of stock-related apps ready to be downloaded from an android device or an iPhone/iPad. Which ones are the best? Well, it depends on exactly what you need. These apps can do a variety of things for investors with mobile devices. THe programs listed below can all be used on an iPod/iPhone.

1. Stock Guru – helps you choose stocks based upon risk, valuation, financial strength, and momentum. Each stock gives you a guru rating, valuation rating, momentum rating, stock screening, financial strength, and much more. This is a pay app.

2. Stock Ticker-Picker – Provide stock charts, quotes, and technical analysis. Another pay app, but cheaper than the first one.

3. Stock Touch – Has one of the best interfaces of any of the stock apps. Is a free app.

4. Stock Twits – Very close to a stock version of Twitter. Also free.

5. Market Scan – Technical Analysis with many tools. One of the most expensive apps mentioned here.

6. Stock Board Free – Arrange all of your market data in one place for free.

7. Stock Signal – Technical trading model that is free.

8. Stock Trader’s Almanac – A very good stock book for $32.99.

9. CNBC Business News and Finance – Great mobile app for business info.

10. Tablet Trader – Provides access to options, stocks, forex, and futures.

Please let us know which app or apps you like the best.

|

|