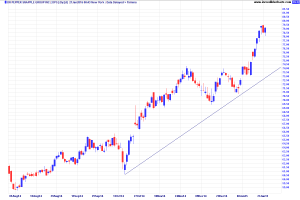

Dr. Pepper Snapple (DPS) is not exactly a new company or stock, but it has been acting like a new breed beverage company that has been strutting it stuff in front of the big two beverage giants known as Coke and Pepsi. Just take a quick look at the chart below to see what I am talking about. DPS has been doing extremely well, while the big two have been somewhat flat in comparison. When I was an active investor and stock analyst between 1994 and 2002, Coke was the undisputed beverage king with Pepsi a distant second in terms of the beverage side. Dr. Pepper has been a well-known soft drink but was tied into Cadbury Schweppes at that time and not doing much. Snapple was much younger, but was acquired by Quaker Oats in a great example of an acquisition that was a bad fit from start to finish. It also did not last long as Quaker Oats quickly sold Snapple again for much less than what it first paid for it.

Fast forward to 2008 and Dr.Pepper and Snapple are together after being spun-off from Cadbury Schweppes to form one of the biggest beverage companies in the world. The company owns such well-known brands as Dr Pepper, Snapple, 7 Up, Canada Dry, A&W, Crush, Squirt, Sunkist, Hawaiian Punch, and Motts. By focusing only on brands such as these instead of other areas like food and candy, the company has made itself very attractive to Wall Street.

DPS currently has a Price Earnings (P/E) Ratio of 22 and a Price Earnings to Growth Ratio of 2.55. Neither are exactly cheap, but that has not stopped the stock from recently hitting a 52 week high of $79.49. That said, it is above an attractive buy price right now. If the stock fell down to around the mid 70s, it would be much more attractive.

Leave a Reply